As a parent, ensuring your children are cared for in any circumstance is one of the most important decisions you can make. But have you ever considered who would take care of them if you were no longer able to?

Choosing a legal guardian for your minor children is a critical part of estate planning that many parents overlook. Without a designated guardian, the courts will decide who raises your children—a process that may not align with your wishes. Here’s what you need to know to make the best choice for your family.

Why Naming a Guardian Matters

Life is unpredictable, and while no parent wants to think about worst-case scenarios, planning ahead ensures that:

- Your children are raised by someone you trust

- Family disputes are minimized over who should take responsibility

- Your values, traditions, and parenting style continue even if you’re not there

- Court intervention is avoided, preventing long and emotional legal battles Tax – Certain inherited assets, like retirement accounts, may be subject to income tax when withdrawn.

Key Factors to Consider When Choosing a Guardian

Selecting the right guardian involves more than just picking a close family member. Consider these factors:

- Shared Values & Parenting Style – Does this person align with your beliefs, lifestyle, and how you want your children to be raised?

- Emotional & Financial Stability – Can they provide a loving, stable home and manage the financial responsibility of raising a child?

- Existing Relationship with Your Child – Is this someone your child knows and trusts?

- Age & Long-Term Commitment – Is the potential guardian in good health and capable of raising your child until adulthood?

- Location & Living Situation – Would your child need to relocate? How would a move affect their education and social life?

The Legal Steps to Naming a Guardian

Once you’ve chosen the right person, it’s important to make it legally binding:

- Include Guardianship in Your Will – Clearly name the guardian(s) in your estate plan to prevent confusion or disputes.

- Discuss with Your Chosen Guardian – Ensure they are willing and prepared for the responsibility.

- Consider Alternate Guardians – Have a backup in case your first choice is unable to serve.

- Update Your Estate Plan as Needed – Circumstances change, so review your decision regularly.

Watch Our Expert Discussion on Estate Planning

🎥 Watch the full video here to gain valuable insights from an expert who understands the financial challenges of estate planning and inheritance. Don’t forget to subscribe to our channel for more helpful resources on probate, estate planning, and financial strategies.

Our videos are designed to make these complex topics simple and actionable. Click the button below to subscribe to our channel!

Ready to Take the First Step?

If you’re feeling overwhelmed, don’t worry—we’re here to help. Book a free 20-minute call with Ashley to get personalized advice on your situation.

Let’s work together to create a plan that ensures your family’s future is secure and stress-free.

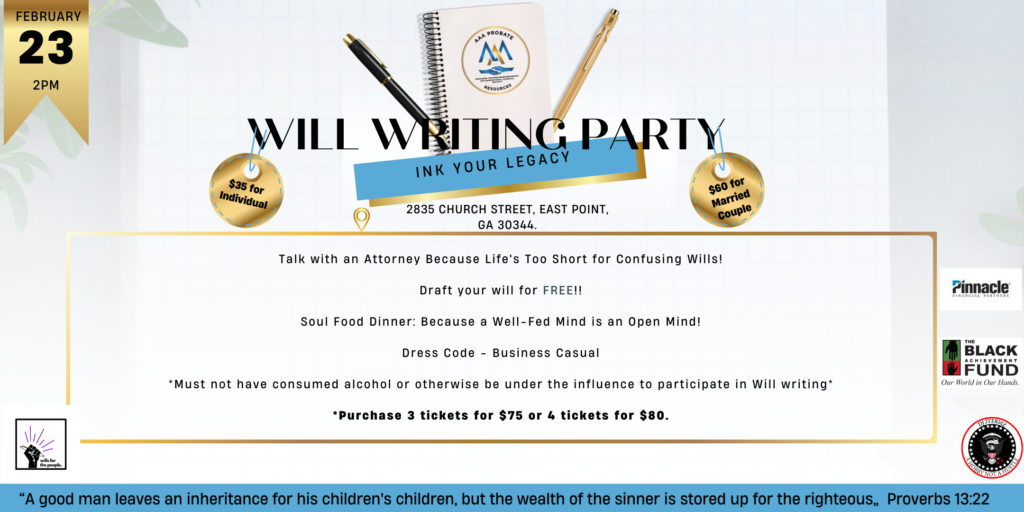

Join Us for Our Upcoming Will Writing Party!

Making a plan for your family’s future doesn’t have to be overwhelming. If you haven’t created a will yet, now is the perfect time!

At this event, you’ll have the chance to draft your will for free while enjoying a delicious Soul Food Dinner and a live DJ in a relaxed, business-casual atmosphere. Our legal experts will guide you through the process, ensuring that your children’s future is secure.

💡 Seating is limited, so reserve your spot today!

Want to stay informed about more estate planning workshops and educational events? Follow our Eventbrite page to be the first to know about upcoming opportunities to protect your family’s future.

Stay Connected

For more tips on estate planning, follow us on Instagram where we regularly share valuable insights and resources.